080-23726969 9900006131 / 9900006140

Mr. K. C. Ashok

Founder-Chairman, Managing Director

Welcome to Akarsh Deepa Chits India Pvt. Ltd.

Akarsh Deepa Chits India Pvt. Ltd. is ably headed by Mr. K. C Ashok. As Managing Director / Proprietor / Chairman/ Managing Trustee Of AD Group - Ashok Group of Companies & KBC Trust (R) - Ashok Group of Institutions.

Namely,

Akarsh Deepa Chits India Pvt Ltd, Ashok Souhardha Co-operative Society, Ashok Finance Corporation (R),Roshan Developers & Promoters, Devika Gasoline Park – HPCL Dealer, Hotels & Restaurants, Ashoka Theatre, Vishnu HP Gas Gramin Vitrak – HPCL Dealer.

AND

Ashok International Public School - CBSE, Ashok International School - STATE, Ashok Composite PU College – Science & Commerce, Ashok Girls PU College Science, Ashoka Polytechnic: - Mechanical/Civil/Automobile/Electrical/Computer Science, Ashok Private ITI – Fitter, Electrician, Diesel Mechanic, DR Academy – NEET Coaching Academy (LTM).

1. Salient features of AKARSH DEEPA CHITS INDIA PVT. LTD.

We have a subscriber base of 5,000 members who repose their trust in this gigantic company. They have all been satisfied customers who are mostly repeated members and many of them have continuously maintaining accounts with the company since the past 10 years. This speaks of their satisfaction in the service rendered by the company.AKARSH DEEPA has done 40 cores of qualitative business turnover which comprises members from different walks of life like Doctors, Chartered Accounts, Advocates, Government employees and business people.

We have an excellent track record of 99% recovery, which is a key to any successful financial company. Good recovery is possible only with qualitative members.

Most importantly AKARSH DEEPA has earned great reputation for best and timely payments of prize money. We are eager to make the payment to the members since a satisfied member gives us more business.

We are very keen in proper sureties/Guarantors for the future liability of a prize subscriber since we have to protect the interest of the saving members (i.e. Non Prized Subscribers)

MOBILE APP AVAILABLE FOR ALL CUSTOMER, Customer can view their ac copy & other related information with fingertip

FULL COMPUTERISED BUSINESS- (I.E. Online collection/sms alters for receipts and payments/email alters)

COLLECTION FOR THE CHIT CAN BE MADE AT YOUR DOORSTEPS (On a daily/weekly/monthly basis)

2. What are the benefits of a chit fund?

Chit fund is a unique financial concept, which has flexibility to borrow or save. By paying one-month installment amount, a person can get to borrow from the chit value, by offering a discount not exceeding the maximum limit ascertained in the chit agreement.In a chit value of Rs.500000/- for a period of 50 months, first the subscriber can get an amount of 350000/-by paying only Rs.10000/- and remaining installments he pays over a period of 50 months. The rate of borrowing is much cheaper than several other financial schemes.

The non prized subscriber who is a saving member upto the last installments gets dividend which is comparatively higher than the interest that are accrued by way of Recurring Deposit Schemes.

The purpose of drawing the prized amount need not be disclosed. It can be used for any need by the member for Example: House construction, Marriage, Education, Expansion of business, buy a Computer or any other purpose at his discretion.

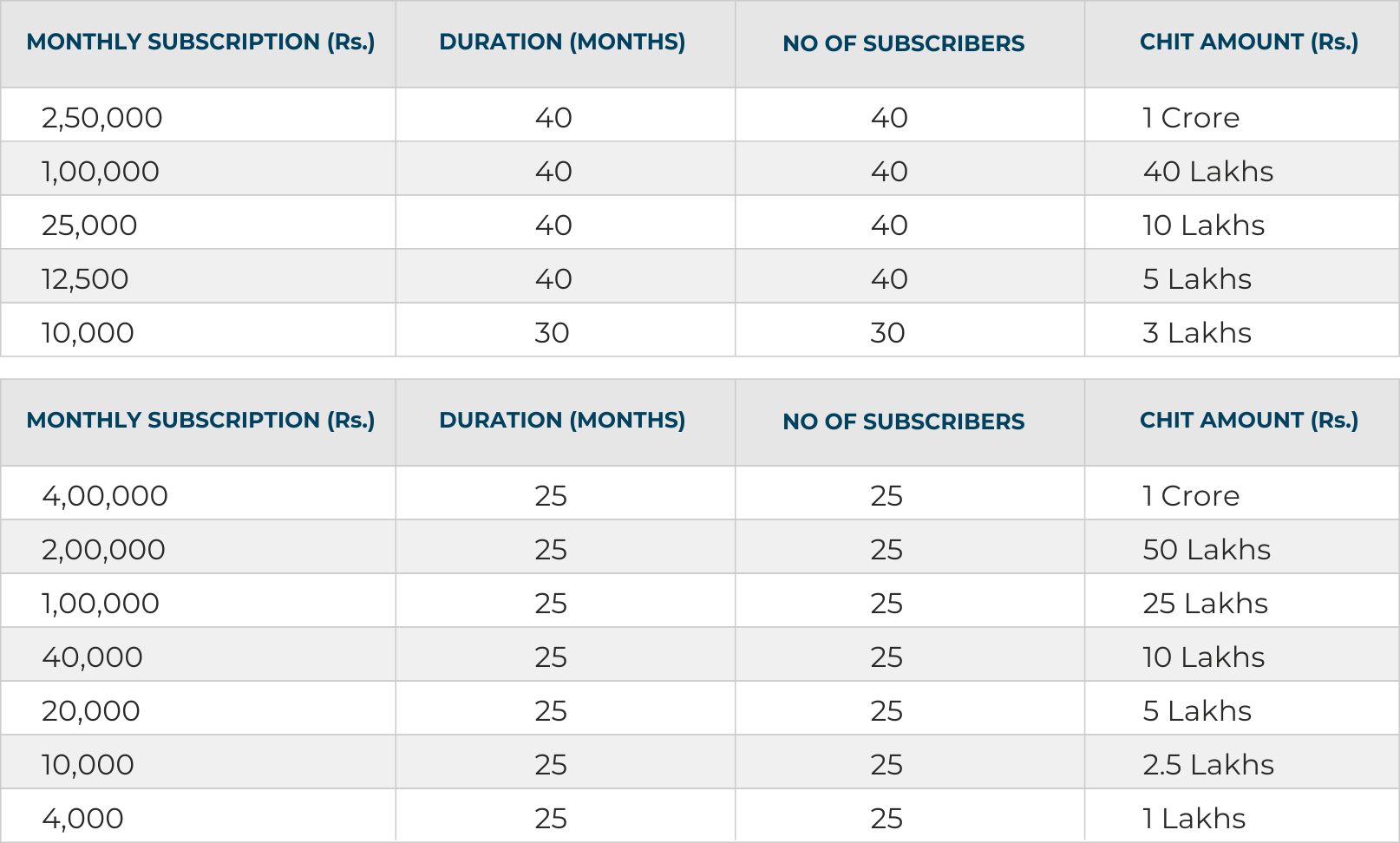

3. What are the various chit groups available in AKARSH DEEPA?

Akarsh Deepa chit fund is having a wide range of chit groups available which suits all walks of people for Example: Individual, Employee, Professionals, Agriculturists, Land Lords, Proprietors, Partnership firms, companies, corporate offices, Organization etc., It has a wide range of Chit values starting from Rs.100,000/- to a maximum range of Rs.1,00,00,000/-.4. What is the duration of these chits?

AKARSH DEEPA is having various range of chit duration. They are 50 months (Long Term), 40 months (Forty Term), 30 months (Thirty Term), and 25 months (Short Term), groups with 50, 40, 30 and 25 members respectively forming the group.5. How many chits can I take in a chit group?

A person cannot take more than 2 (Two) chits in a group that too he should have paying capacity for the same.6. What are the modes of payment?

Member can make payments either by cash, Demand Draft or cheques. Third party cheques are not acceptable. Issued cheques have to be realized before the auction date if the member wants to participate in auction.Online Payment Facility: Pay online directly from your Bank Account through Net Banking.

7. What is the security for my money?

A Registered Chit Fund Company makes a Security deposit equal to 100% of chit value in a Schedule Bank as FDR, which is pledged in favor of registrar of chits. Therefore, a member in a registered Chit Fund Company is very much secured than a member in a non-registered company.8. How are Auctions conducted?

Auctions are conducted in the branches where in the foremen declares the successful bidder. All non-prized subscribers who have paid their Installments up to date are eligible to participate in the auctions. In case the payment is made by cheque the cheque should have been realized oneday before the auction date. For every group the auction time is 5 minutes on a specified date and time. It is upto the members to be present in the auction hall 10 minutes before auction time as verification has to be done by branch for signatures of members and identification of proxies and their Bid Authorization letters.

During the first few months there will be more number of participants willing to bid at the maximum discount. This maximum discount is predetermined for each group and should not go beyond 40 % of Chit value.

■ The maximum bid limit varies between 30% to 40% depending on the duration of the chit. Out of which 5% of the chit value is the company's commission and the balance percentage is distributed as dividends equally among the members in the group. The member pays the next installment minus the dividend and the dividend amount is credited to his account.

■ When there are more members for maximum discount their tokens are put in a box and one token is picked by way of lottery. The member who holds the ticket that is marked on the picked up token is declared as successful bidder who has to submit the required sureties depending on the Future Liability.

■ When there are no maximum bid offers in the auction members can participate in open bidding during the auction time. When there is no maximum discount bidding members are supposed to participate in open bidding during auction time, which starts with a minimum 5% of chit value or any bid offer that has been given by a member prior to auction time. Members are supposed to bid in multiples of Rs.100/- from the minimum bid offer amount and the person who quotes the highest bid amount on the completion of 5th minute shall be declared the successful bidder by the foremen.

If there are no offers above the bid offer the member who has given the highest amount as bid offer is declared as successful bidder. Bid offer is to be given to the office 24 hours prior to the day of auction in which one can mention the maximum bid amount that is acceptable to them. If a member is unable to participate in the auction the member can authorize some other person whose signatures has to be authenticated by the member. Generally member authorizes the family member or Development Officer's and Agents as proxies to participate in the auctions.

9. When can I participate in the auction?

A member can participate in auction right from the first auction itself, only if he or she has made the payments up to date. If paid by cheque, it should be realized before the auction date. A defaulter whose payment is not upto date before auction is not eligible to participate in the auction.10. What is the purpose of bidding?

In every chit group some members will be in need of money. So all the members who are in need of money will be participating in the auction for bidding. The purpose of bidding is to declare the successful bidder who gives the highest bid amount (Not exceeding maximum limit) within the specified auction time i.e. 5 minutes.11. What is the benefit from saving in chit?

There will be a compulsory saving which will earn dividends every month. Even if you take at the last month, the total dividends earned will be more than the bank interest rate.12. What are the Income Tax benefits from saving or borrowing?

The dividends earned in a chit are not taxable. If you want to claim the bid as loss then these dividends has to be shown as revenue income in the assessment. Hence the entire dividend earned in a chit is not taxable if you don't claim the bid amount as loss.13. What is chit dividend?

Auction discount minus company commission (5% of chit value) is the total group dividend. Total group dividend is distributed equally amongst all the subscribers. This dividend so distributed is deducted from the next installment payable by the subscriber.14. What are the sureties to be submitted?

■ A member can give sureties depending on the future liability of the chit. Following are the sureties generally submitted by the members.1. Personal Surety: Any salaried person working in State/Central Govt./ Public Limited Companies/Banks and other Reputed Companies will be taken as surety.

2. Pledge: Deposits with the company in chits or otherwise, net paid amount of which, after deducting foreman's commission should not be less than 150% of the successful bidder's liability to the company.

3. Bank Guarantee: Guarantee given by the Schedule Bank in a schedule format can be submitted as surety.

4. Income Tax Assessor: Any person having I T Assessment for the past three years having business, profession etc will be taken as sureties.

5. Property Pledge: Deposit of title deeds of urban property can be submitted as surety. Third party property can also be given as surety. Prized amount shall be disbursed after the bidder provides collateral security of properties to the extent of 150 % to 175% of the Future Liability acceptable to the company.

Benefits of Akarsh Deepa Chits:

- In-built provision for borrowing at a short notice by bidding successfully

- Being able to save in Installments

- Having decided to join chit, deferring other avoidable expenditure, if necessary

- Convenience and abscence of stringent formalities

- Chit Fund forms a very popular method of saving and borrowing

- Akarsh Deepa Chits being a prestigious PSU, ensures 100% safety, reliability and transparency in operations

- Akarsh Deepa Chits ensures safety of the subscribers’ investment

- Chits provide for an assured sum during a crisis

- Chits provide easy availability of hard cash

- It is a way to get Money at 0% Interest

BENEFITS

- Hind Sight Benefits

- Freedom to use funds

- Rate of Interest on borrowing

- Rate of Return on Savings

- Tax

CHIT FUNDS

- Hind Sight Benefits Start as savings and convert into a borrowing instrument, if and when required. Choose between savings and borrowing options – Whether Savings, FD or Loans

- Subscriber has the freedom to use the funds as per thier will.

- Since the chit funds work under the principle of mutuality, you borrow from your future savings.

- Risk free when compared to any other financial intermediary

- Dividend earned is Taxable, GST Applicable.

BANKS & OTHERS

- Choose between savings and borrowing options – Whether Savings, FD or Loans

- Freedom to use funds Subscriber has the freedom to use the funds as per thier will. Loan is for specified purpose – be it home-loan, vehicle, business etc.

- The Banks & other NBFC borrow money at interest, add service charges and lend at higher rates.

- As cost of operations is very high and also the prevailing interest rate is a factor

- Applicable. The interest earned from Savings a/c, FDs, etc is subject to Tax.

How Chit Fund Works

CHIT provides a good source of finance for different type of people viz., small investors, businessmen, small scale industrialists etc.CHIT is a good means of savings for any contingency requiring substantial amount.

It serves all persons whether they desire for savings or borrowing to meet extraordinary expenses on special occasions like Marriages, Construction of houses , business , Education etc.,

Adequate care is necessary to choose a suitable Group. The selection of a particular Group, largely depends on the subscriber’s capacity to provide surplus funds month after month from his normal income for this purpose. This aspect is very important for the subscriber as well as the company’s point of view to avoid any embarrassment at the time of releasing the prize money or in releasing chit instalments month after month.

What is a Chit?

The Pooled funds every month are offered to the subscribers at monthly AUCTIONS and the subscriber who BIDS for the highest DISCOUNT is declared the PRIZE WINNER and given the PRIZE AMOUNT on PROPER SECURITY . A Prized subscriber also should continue to pay the subscriptions till the termination of the chit. The amount foregone as discount, less foreman’s commission is distributed among the subscribers as dividend.

What is a Chit Group?

Who is a foreman?

Is the contract of the subscribers with the foreman valid for an indefinite period?

What are the benefits of chit subscribers?

2. To borrow the future savings in advance. Some subscribers join chit funds to borrow and others to save.

asta

asta